MILTON, N.Y., January 14, 2019 – Sono-Tek Corporation (OTCQX: SOTK), the leading developer and manufacturer of ultrasonic coating systems, today reported financial results for its fiscal 2019 third quarter and year-to-date period ended November 30, 2018.

Financial Highlights

- Net sales increased 7% to $3.2 million in the quarter and were up 7% to $8.7 million for the year-to-date period

- Backlog more than doubled and reached a record level of $3.0 million at quarter end, which includes an order for the Company’s highest value ultrasonic coating machine to date

- Advancing market position in China fuel cell market: shipped three ultrasonic coating solutions to new fuel cell customers during the quarter

“The effectiveness of our efforts to provide application engineering expertise and more complete subsystems increased customer demand for custom-designed, higher value, complex machines as well as higher demand from original equipment manufacturers for application-focused subsystems,” commented Dr. Christopher L. Coccio, Chairman and CEO. “In particular, we are pleased with our early prospects in the Alternative Energy market in China, having shipped three ultrasonic coating solutions to new fuel cell customers during the third quarter. We expect that over the long term, demand from this market is poised for substantial growth as the industry continues to scale up from R&D prototype production to low rate production.”

Dr. Coccio concluded, “We expect solid mid-single digit sales growth for fiscal year 2019 including the impact of lighter fourth quarter shipments due to timing. Fourth quarter fiscal 2019 sales are expected to be generally in line with the prior year’s period. Fiscal 2020 should be another year of solid sales growth given our robust pipeline of opportunities and record backlog.”

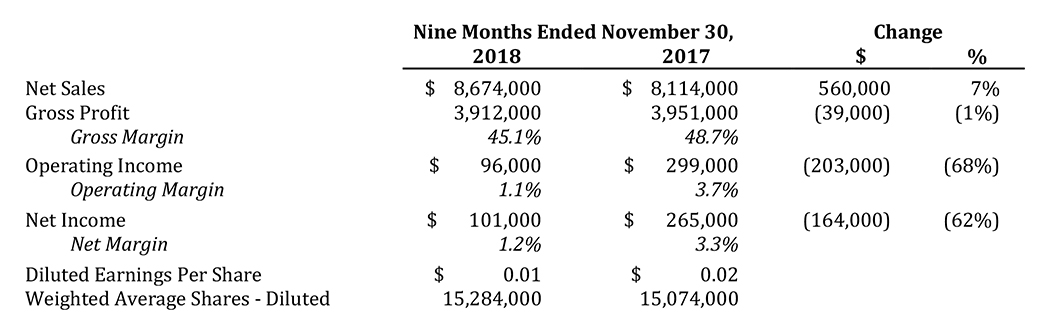

Year-to-Date Fiscal 2019 Results (Narrative compares with prior-year period unless otherwise noted)

The net sales growth in the year-to-date period was driven primarily by increased demand of highly customized, more complex systems from the Alternative Energy and Medical markets. As expected, third quarter sales were measurably stronger to Alternative Energy customers driving this market’s year-to-date sales up 41% to $1.6 million.

Use of the Company’s development laboratory by customers to develop their products and validate the capabilities of Sono-Tek’s coating technologies has recently reached record levels. In particular, the Medical industry has been especially active in the Company’s lab and, as a result of providing application engineering expertise along with paid coating services, helped drive year-to-date Medical market sales of $2.7 million, up 20%.

In the first nine months of fiscal 2019, approximately 62% of sales originated outside of the United States and Canada compared with 57% in the prior-year period.

From a product sales perspective, year-to-date Multi-Axis Coating Systems increased $797,000, or 26%, to $3.8 million as a result of higher sales of more complex, highly engineered and higher value machines primarily for the Medical and Alternative Energy markets. OEM Systems were up 60%, or $519,000, to $1.4 million as the Company continued to successfully provide subsystems and components, including the custom-designed Align system, to OEMs. These increases more than offset the decline in sales of Integrated Coating Systems, which primarily are for more mature applications in the Medical market and can be highly variable in order volume. See the accompanying tables at the end of this release for a breakout of sales by Market and Product for the nine months ended November 30, 2018.

Gross margin was negatively impacted by the change in product mix toward more complex machines requiring more outsourced hardware content such as advanced motion control systems. Operating expenses were up in the period as the Company continued to invest in research and product development as well as marketing and selling activities in order to expand its future market opportunities. This includes additional software and resources as the Company begins to integrate smart technology into its products.

In the first nine months of fiscal 2019, net income and earnings per share reflect $189,000 of unrealized losses on marketable securities.

Backlog of $3.0 million more than doubled from $1.2 million at the end of fiscal 2018 and $1.4 million at the end of the trailing second quarter of fiscal 2019. Included in the recent backlog total was the order for an approximately $1.7 million ultrasonic coating machine, the single highest valued machine in the Company’s history. This machine is scheduled to be delivered by the end of fiscal 2020, which concludes on February 29, 2020. Orders can be highly variable from quarter-to-quarter resulting in large fluctuations in backlog, as product shipments are more systematically managed for both customer timing requirements and staffing management. Excluding the large machine order, the remainder of the backlog is expected to ship within one year.

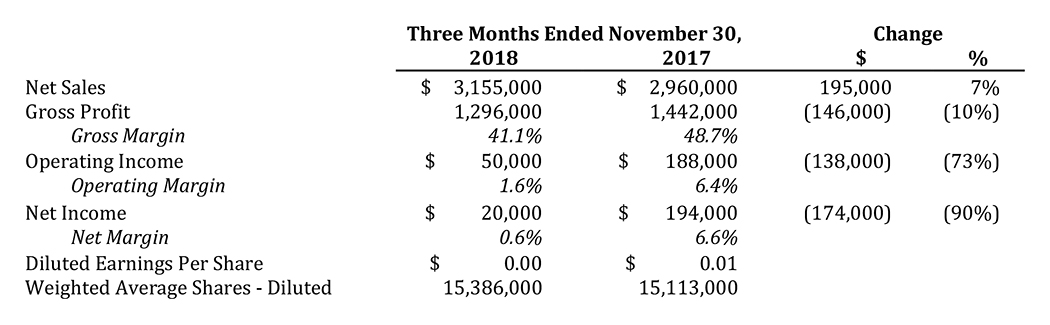

Third Quarter Fiscal 2019 Results (Narrative compares with prior-year period unless otherwise noted)

Net sales growth was driven by higher value multi-axis coating machines primarily for the Alternative Energy market in the third quarter. See the accompanying tables at the end of this release for a breakout of sales by Market and Product for the three months ended November 30, 2018. Approximately 62% of sales originated outside of the United States and Canada in the third quarter compared with 60% in the prior-year period.

The change in gross margin reflects similar commentary as the year-to-date discussion above combined with an aggressive pricing strategy to establish a leading foothold in the China fuel cell market. Net income and earnings per share reflect $59,000 of unrealized losses on marketable securities.

Balance Sheet and Cash Flow Overview

Cash and cash equivalents and short-term investments at quarter-end were $5.7 million, down from $6.4 million at the end of fiscal 2018. The decline was the result of the timing of working capital requirements primarily due to an increase in receivables and inventory. The increase in accounts receivable was due to a large number of orders being shipped in the last month of the quarter to accommodate customer scheduling requests. Higher inventory is to address both customer demand for shorter delivery cycles and increased order levels.

Year-to-date capital expenditures were $487,000 compared with $158,000 in the prior-year period. The increase was primarily due to investments of $337,000 to upgrade the Company’s CNC machinery. The Company expects that capital expenditures for the remainder of the fiscal year to be nominal for a total of approximately $0.5 million.

At November 30, 2018, the Company had total debt of $910,000, down $117,000 since fiscal 2018 year-end. Long-term debt is comprised of the mortgage on the Company’s industrial park complex and has an interest rate of 4.15%. Sono-Tek has a revolving credit line of $750,000, of which $659,000 was being utilized to collateralize a letter of credit issued to a customer that has remitted a cash deposit on an order.

About Sono-Tek

Sono-Tek Corporation is the leading developer and manufacturer of ultrasonic coating systems for applying precise, thin film coatings to protect, strengthen or smooth surfaces on parts and components for the microelectronics/electronics, alternative energy, medical and industrial markets, including specialized glass applications in construction and automotive. The Company’s solutions are environmentally-friendly, efficient and highly reliable, and enable dramatic reductions in overspray, savings in raw material, water and energy usage and provide improved process repeatability, transfer efficiency, high uniformity and reduced emissions. Sono-Tek’s growth strategy is focused on leveraging its innovative technologies, proprietary know-how, unique talent and experience, and global reach to further develop thin film coating technologies that enable better outcomes for its customers’ products and processes. For further information, visit www.sono-tek.com.

Safe Harbor Statement

We discuss expectations regarding our future performance, such as our business outlook, in our annual and quarterly reports, news releases, and other written and oral statements. These “forward-looking statements” are based on currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors must recognize that events could turn out to be significantly different from our expectations and could cause actual results to differ materially. These factors include, among other considerations, general economic and business conditions; political, regulatory, tax, competitive and technological developments affecting our operations or the demand for our products, including the imposition of tariffs; timely development and market acceptance of new products and continued customer validation of our coating technologies; adequacy of financing; capacity additions, the ability to enforce patents; maintenance of operating leverage; maintenance of increased order backlog; consummation of order proposals; completion of large orders on schedule and on budget; continued sales growth in the medical and alternative energy markets; successful transition from primarily selling ultrasonic nozzles and components to a more complex business providing complete machine solutions and higher value subsystems; and realization of quarterly and annual revenues within the forecasted range. We refer you to documents that the company files with the Securities and Exchange Commission, which includes Form 10-K and Form 10-Qs containing additional important information.

For more information, contact:

Stephen J. Bagley

Chief Financial Officer

Sono-Tek Corporation

info@sono-tek.com

Deborah K. Pawlowski

Investor Relations

(716) 843-3908

dpawlowski@keiadvisors.com

FINANCIAL TABLES: https://www.sono-tek.com/wp-content/uploads/2019/01/20190114-SOTK-Q3-FY19-Release-FINAL.pdf